Understanding the UK National Minimum Wage

The UK National Minimum wage is changing on April 1st 2022, and this article explains why.

Photo by Colin Watts on Unsplash

If you are coming to work in the UK, it is important you understand the National Minimum wage so you are aware of your legal entitlements.

What is National Minimum Wage?

By UK law, employers must pay a minimum amount on average for the hours worked by the employee. This is what is known as the National Minimum Wage (if you're aged under 23 or the National Living Wage (if you're aged 23 or over). This means you are automatically entitled to receive the National Living Wage once you turn 23. The minimum wage rates apply uniformly across the UK and sectors.

As an employee, you must be paid the National Minimum wage or National Living Wage regardless of your type of employment – Part-time, full-time, contract staff, and apprenticeship. Although, the National minimum wage levels vary, depending on your age and whether you are an apprentice.

So what’s changing?

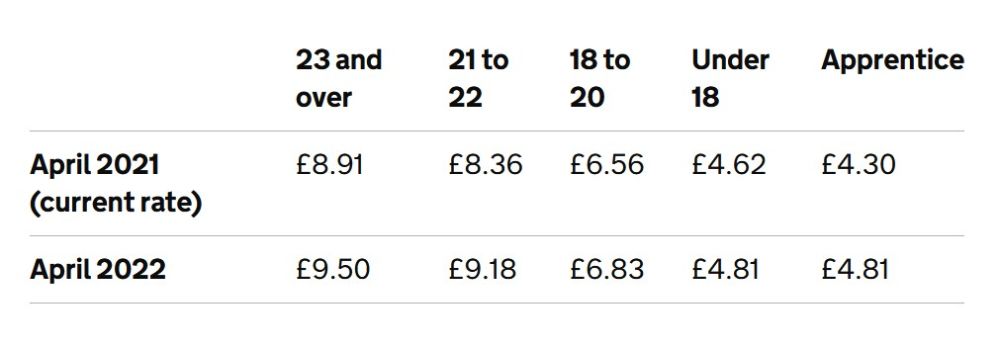

Below are the updated National minimum wage rates coming into effect on 1st April.

2023 (updated rates)

The minimum wage rate is usually reviewed upward every year by the government based on the recommendation by the Low Pay Commission and this year is no exception.

The review of the minimum wage is usually based on an assessment of the economic conditions, income and the cost of living.

Does the minimum wage law apply to me?

The only time the minimum wage law is not applicable includes when an individual is self-employed, a director in your company, undertaking work as part of a course or work shadowing, a member of the armed forces or below the school leaving age.

What counts towards my minimum wage?

You can use the National Living Wage and the National Minimum Wage calculator on the government website to always check if you are being paid correctly.

Your employer could make some deductions from your pay that could leave you with less than the minimum wage. Examples of such deductions include – Tax and National Insurance contributions, Pension contributions, Trade union fees and charges for accommodation provided by the Employer.

However, some work benefits such as tips, service charges, travel allowance do not count towards the minimum wage calculation.

What to do if you are being paid less than the minimum wage

If you are being paid less than the minimum wage despite the approved deductions, you can take the following steps to rectify the situation:

- By raising the issue with your employer to see if it’s a mistake and seek rectification.

- Make a claim to an employment tribunal

- File a complaint to the HMRC customs (this can be done anonymously)

How does reporting to the HMRC help?

The HMRC (the UK government’s employment and tax body) will investigate and issue an enforcement notice if your complaint has merit. Furthermore, employers face the risk of penalties and fines for non-compliance. The government also names and shames such companies for violating these regulations.

Employees are legally obliged to pay the National minimum wage regardless of the size of the company so in a case where you discover that you’ve been underpaid, the HMRC can force your employer to pay the difference of what they owe.

Another way to seek assistance is by reaching out to the Advisory, Conciliation, and Arbitration Service (ACAS) through their helpline.

Despite the fact that the cost of living is significantly higher in some parts of the country, there are no variations on the minimum or national living wage as the rates are fixed at the national level.

Maze provides an end-to-end platform that disrupts the traditional relocation model.

We connect people relocating with service providers, reduce cost and enable the personalization of customer journeys to the UK.

Follow us on Instagram, Twitter, Facebook and LinkedIn, or Contact us with your relocation enquiries.